When it comes to balancing your budget, there are plenty of options, including smartphone budgeting apps. But sometimes, you don’t necessarily need or want bells or whistles or in your quest to save more money. And for those who find satisfaction in balancing a checkbook, tech tools just aren’t the same.

Enter bullet journaling, or #bujo. Originally a type of productivity tool that allows users to track progress, goals, and to-do lists, bullet journals have also been found to be effective money-management tools. You’ll use pen and paper as a tool to connect with your finances, see where your money is going, and track your financial goals.

What is a bullet journal?

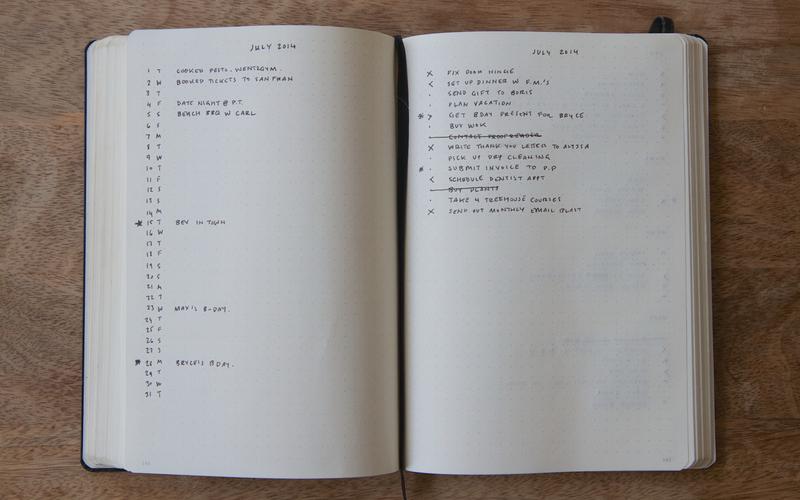

A bullet journal is a journal designed to track habits, maintain to-do lists, and generally organize a schedule via pen and paper. Official Bullet Journals can be purchased, but many people DIY their own via whatever journal they choose. What tends to separate bullet journaling apart from traditional journaling is the use of graphs, charts, and symbols to illustrate a completed task or project. Another key difference is the inclusion of an index, or table of contents, in the bullet journal, to easily reference different parts.

In general, a bullet journal isn’t meant to dive deep into the darkest parts of your subconscious. It’s more a place to easily keep track of ideas, to-do lists, and yes, money moves.

How to use a bullet journal for personal finances

If you search #bujo or #bulletjournal on Instagram, you’ll see examples, or spreads, of various layouts used in a bullet journal. These spreads can be artistic or fanciful, but the key similarity is that they are all designed to make their owner’s life easier. For example, this bullet journal spread acts as a budget tracker and savings log:

![]()

Image credit: @feminist_bujo

A bullet journal can be whatever you make it. Here are some creative ways and reasons to use a bullet journal as a way to keep track of personal finance goals.

It should be noted that a bullet journal should not be used to store sensitive info, like passwords or account numbers, but as a general place to keep financial questions, goals, and nagging reminders in one place.

Track daily spending

If a tech tool isn’t intuitive, getting in the habit of writing daily spends via pen and paper can be a way to easily track spending, note any behaviors, or find places where it may be possible to save. Seeing your budget can make transactions feel more tangible than they may have felt if you’re only seeing money auto-deducted from your account. To find inspiration, search #spendingtracker on Instagram.

Image credit: @everydaybulletjournal

Focus on a savings goal

One popular way to use a bullet journal for finances is to use it as a visual way to represent a major savings goal. Adding a visual component — like this hand-drawn brick wall, with each brick representing $10 — can make the savings goal feel more tangible than it may have felt if you were simply putting aside money in a savings account.

Image credit: littlecoffeefox.com

Track monthly bills

Even if you have bills set on autopay, seeing your monthly bills written down in one place can help you remember where your money is going — and see how much you’re paying in total on bills each month.

Track upcoming expenses

One brilliant way to use a bullet journal to keep financially organized is to have lists of upcoming birthdays, holidays, and wish lists from various family members. That way, it’s easy to take advantage of sales or coupons to buy gifts throughout the year. It can also be a good place to keep track of need-to-know dates that may save you money. For example, does day camp tuition rise in February? When will your yearly pool membership be billed? Keeping track of every financial obligation of the year on one bullet journal spread can remind you when your monthly budget may fluctuate.

Make money conversations fun

If you’re the type to zone out when you see numbers on a screen, a bullet journal — complete with the ability to let your imagination flow on paper — can be a great way of merging creativity with financial goals. As with any financial tool, the key is to find one that can be satisfying to use, helpful to see, and fun in the moment, so your personal finances don’t feel like a chore. Having the journal on hand can also be helpful when discussing money with your partner, especially if one of you needs to see a concept to better understand it.

Keep financial to-dos in one place

Work with an estate planner. Talk with an accountant about 2018 taxes. Consider insurance needs. Buy life insurance. Chances are, you’ve got dozens of to-dos that haven’t yet been done. Committing these to-do lists to paper can be a great first step toward making them a reality. Using a financial journal can also be a way to keep track of notes, questions, and things to consider, and can also be something to share with your spouse so he or she can also do some of the legwork. Some people might prefer working on a spreadsheet, but if pen and paper work for you, a financial bullet journal could be a way to make headway on your 2019 financial goals.

Share financial goals as a family

A family bullet journal, including spreads for saving up for an upcoming vacation, can be a great way to get the whole family involved in discussing money, learning how to save, and learning that savings and budgeting are everyday actions. Tweens and teens may also be motivated by the creative angle of a bullet journal as a way to track their own spendings and savings goals.

Find a financial system that works for you

Obviously, a bullet journal might not take the place of any virtual or tech tools you already use. But a bullet journal spread can give you a different way to think about money, and can make money management more fun (and definitely a lot more pretty) than it may have been before.

Anna Davies is a writer, editor and content strategist living in Jersey City, NJ. She has written for New York, Glamour, Elle, Men’s Health and others and has written 13 young adult novels under various names. Her favorite things to spend money on are discount theater tickets, oversize sweaters, and cold brew lattes.

Featured image credit: BulletJournal.com